Great Potential of Wood Pellet Supply In Southeast Asia

ALONG with the growing needs of the biomass energy around world, the worldwide wood pellet industry has been developing faster than ever in recent years. An obvious change to the target market, the traditional market as Europe, US, and Canada have to share the pellets with South Korea and Japan, has been taken place due to the energy structure adjustment in these two countries. Meanwhile with the stimulation against in importing wood pellets from the two governments, undoubtedly the two nations has been the main target wood pellet market in Asia. South Korea is being the largest wood pellet import area in Asia.

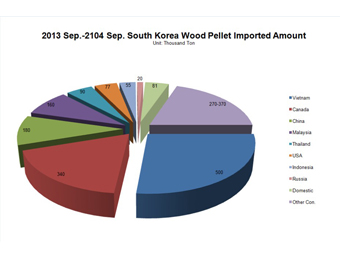

Korean wood pellet import volume has increased by almost 300% in November 2013 and 2014’s first quarter trade has been very likely with over 280, 000 tons of imported wood pellets. As shown in Table 1, the annually import volume of wood pellets from 2013 Sep. to 2014 Sep. is 1, 873, 000 tons. Even though, USD 23.8 million of RPS penalty was imposed in 2103 on only 60% fulfillment of the Renewable Portfolio Standards (RPS) against the six power plants subsidiaries of Gencos. This conveys and idea of the short supplying of wood pellets in the Korean market.

As the traditional wood pellets consumption nations, Canada is still keeping its important contributor to the Korean wood pellet market shown in the table 1, accounting for 18% target market shares, thanks for the abundant raw materials and large capacity of wood pellets. Meanwhile, more Southeast Asian countries have come to realize their own advantages of rich tropical hardwood resources, cheaper labor and land cost, closer to the target market against the wood pellets supplying to Korea.

From 2006, Vietnam seized the opportunity of promoting the domestic biomass pellets industry. Till now, it has been the largest wood pellet supplier to Korea. In the coming years, other countries, like Indonesia, Malaysia, Thailand, who possess the same edge in cheap investment cost, are considered as the most potential pellet supplier to Korea.

Especially for Indonesia, it owns the richest tropical hard wood resources and mature wood processing industry. With our experience in the largest wood pellet factory located in Semarang, the output pellets are very popular in the Korean market, due to the good quality standard. The hard wood raw materials contribute the high calorie value, low ash and chemical content. Now, the wood pellet projects are concentrated in east and central Java areas, where main seaports are located. Still, the Sumatera, Kalimantan, and Pulau Papua areas possess the most forest resources in Indonesia.

In reality, much more wood pellet projects has been booming in Indonesia. Not only did the local investors own the pellet plants, some of the Korean energy companies have been established many pellet lines spreading in the big island. In this just concluded 5TH Biomass Pellet Trade & Power Conference in Seoul, the attendees agreed that Indonesia has the potential to be the next largest wood pellet supplier in Asia. And also the Indonesian attendees appeared the high activity to achieve this goal.

Of course, the other countries like Thailand, Malaysia will also face their huge development opportunity on biomass pellet industry. As the largest supplier of palm oil in the world, Malaysia has large amount of EFB. For Thailand, except for the wood resources, large area of King Grass, sugar cane baggase, rice husk etc. would also be the good raw materials of the biomass pellets. With the liberalization to allow imports of other pelletized biomass (e.g. from Oil Palm Pellet, Torrefied Pellet) into Korea from July 2014, this growth is set to continue as the Korean gencos' co-firing requirement is estimated to be higher than the current imported volume.

In summary, the capacity of the biomass pellets in Southeast Asian countries is far from to meet the growing biomass pellet target market; meanwhile, large amounts of raw materials has not been recycled to the valuable biomass pellet. So the potential Southeast Asian countries should take their own advantages of vigorously develop the wood and biomass pellet industry.